We are currently working on raising equity & debt for a manufactured housing project in the southern US and we have been blown away by how much more affordable it is to traditional stick-built housing. We have also been very impressed with the quality and product offerings currently available in the industry. In this Insights Post we will give you a refresher on exactly what we mean by Manufactured Housing, and also dive into some of the details as to exactly how much more affordable it is to stick built housing.

What do we mean by Manufactured Housing?

Depending on where you live, when you hear the term manufactured housing you might think of an old trailer park filled with junky cars, overgrown lawns, and 1960’s style mobile homes. This is what is often seen in California and what has created a stigma within the industry.

Today, however, modern manufactured housing communities more closely resemble single family subdivisions. Streets are paved with curbs & gutters, lots are +/- 5,500 square feet, lawns and common areas are nicely landscaped, and communities feature 5-star amenity packages with clubhouses, pools, and sports courts. The homes themselves reflect modern architectural designs with high end fixtures and the construction quality is reflective of the precision found in a factory. Take a look at this model by Cavco Homes: The Cottage Farmhouse. This model starts at about $175,000 and features 1,394 square feet and is one of the higher end manufactured homes. Here is another option by Jessup Homes: The Grant. This is a smaller, lower-end model that starts at only $81,000 and features 1,191 square feet.

Affordability:

Homes such as these can be purchased through dealers, similar to the way people buy cars. Once the purchase is complete the manufacturer delivers the home to the community and installs it on its pad site. The new homeowner typically pays a mortgage for the home purchase, and lot rent to the owner of the manufactured home community. On the projects we have seen there is no HOA payment, but the lot rental payment to the community owner pays for common area maintenance of the property and access to the amenities, so its somewhat similar. In a manufactured home community, homeowners own their own homes but rent their lots (typically on annual leases).

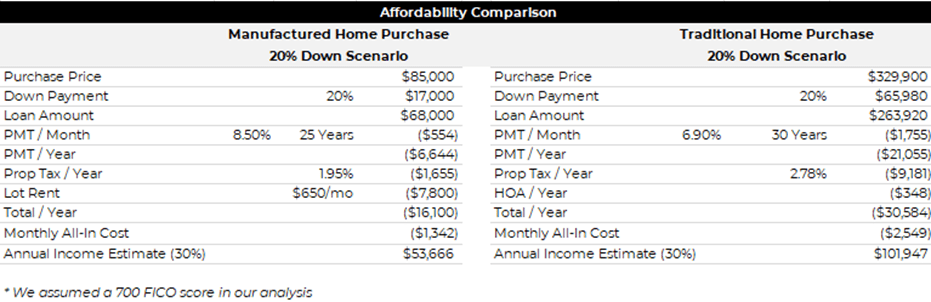

Mortgages for manufactured homes are readily available from several different providers and typically have a higher interest rate than traditional home mortgages. These manufactured home loans can be obtained with as little as 5% down. We recently conducted a survey to compare the cost of a manufactured home to a traditional home. This is what we found out:

Scenario 1: This analysis shows a 20% down payment for an individual with a 700 FICO score. We assumed the purchase of a smaller/lower end manufactured home compared to the purchase of a smaller/lower end single family home of relatively new construction within a market in the southern US. Our analysis showed that the all-in monthly payment for a manufactured home was about $1,342/month vs. $2,549/month for the single family home (savings of $1,207/month or $14,484/yr). In order to be able to afford the purchase, the family would have to have annual income of $53,666 compared to $101,947 for the single family home (based on the 30% of income guideline).

Scenario 2:

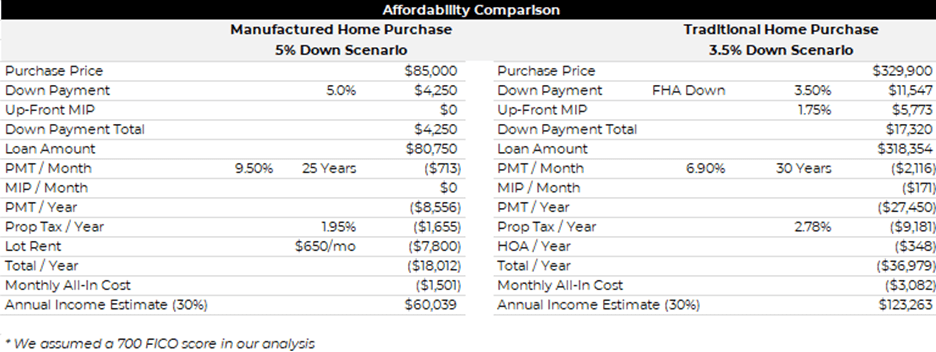

This analysis shows the same purchase, but with different financing assumptions. Here we assumed the minimum downpayment of 5% for a manufactured home purchase compared to the minimum down payment for the purchase of a single family home with an FHA loan.

As you can see, manufactured homes are significantly cheaper and the barriers to entry based on income are much lower. In the long term, both forms of housing appreciate in value and are paid off through amortization of the mortgages. The quality of housing is very comparable. The primary difference is you do not own the land under a manufactured home and will always pay lot rent if its located within a community – and lot rent can go up over time. If you own a home within an HOA though, you will always have and HOA payment – and that can also go up…