The concept of an interest rate “buy down” has been around for a long time in CMBS but until recently it was rarely used. In today’s current market it is proving to be an effective tool for loan originators to help boost loan proceeds for their borrowers. In this Insights Series Post we will explore what a buy down is, and how it works.

What is an Interest Rate Buydown?

A buydown is essentially paying an upfront fee to the lender at closing in exchange for a reduction in the loan’s interest rate. For a 5-year CMBS loan, a fee equal to 1% of the loan amount will get you a 0.24% reduction in interest rate over the term. For a 10 year CMBS loan, a fee equal to 1% of the loan amount will get you a 0.12% reduction in interest rate over the term.

How Does it Result in Increased Loan Proceeds, and Why is it Popular in Today’s Marketplace?

Buying the rate down enables the lender to use the new lower rate in their debt-service-coverage-ratio test (DSCR Test), which helps the property qualify for a larger loan. To fully explain how this works and why its so popular lets start by recapping what has happened in the market over the past 2 years and then provide a mathematical example:

- As most of our readers know, the Fed has raised interest rates by 5.50% since March 2022 in an effort to combat inflation. This has dramatically increased borrowing costs for property owners.

- At the same time, property level income statements have generally gone down. Expenses have risen faster than rents due mostly to inflation and the length of time between rent increases. The properties that have done the best in this market are the ones with shorter term leases.

- Generally speaking, when a property needs to be refinanced in today’s market it is not qualifying for the same amount of financing as it was just a few years ago. The result is that the new loan is smaller than the one that needs to be repaid, which is a BIG problem for many borrowers.

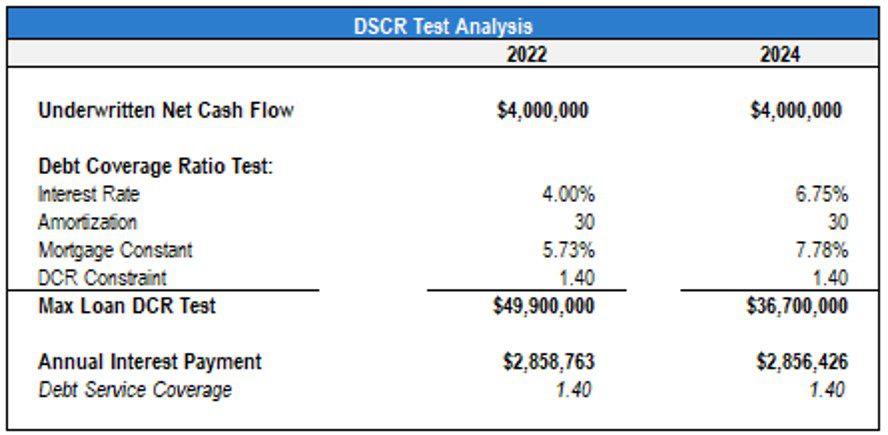

- One of the tests that lenders do to size their loans is called a Debt-Service-Coverage-Ratio test which basically determines how large of a loan they can make at a certain interest rate in order to have sufficient “coverage” or a “cushion” between the property’s net operating income and the loan payment.

- In this example, the lender wants a 40% cushion (a 1.40 DSCR). To illustrate how a DSCR test works we looked back at a CMBS loan we did in February 2022 right before the Fed started raising interest rates. The interest rate that we obtained for our borrower was 4.0%. Today, this loan would be about 6.75%, so not the full amount of the fed’s hike (because spreads have decreased) but certainly a large increase. The net effect is that the same property cash flow supported a $49.9MM loan in 2022 and now only supports a $36.7MM loan. So if you are a borrower that took out a $49.9MM loan and you needed to refinance it because it was maturing you would have to come up with $13.2MM!

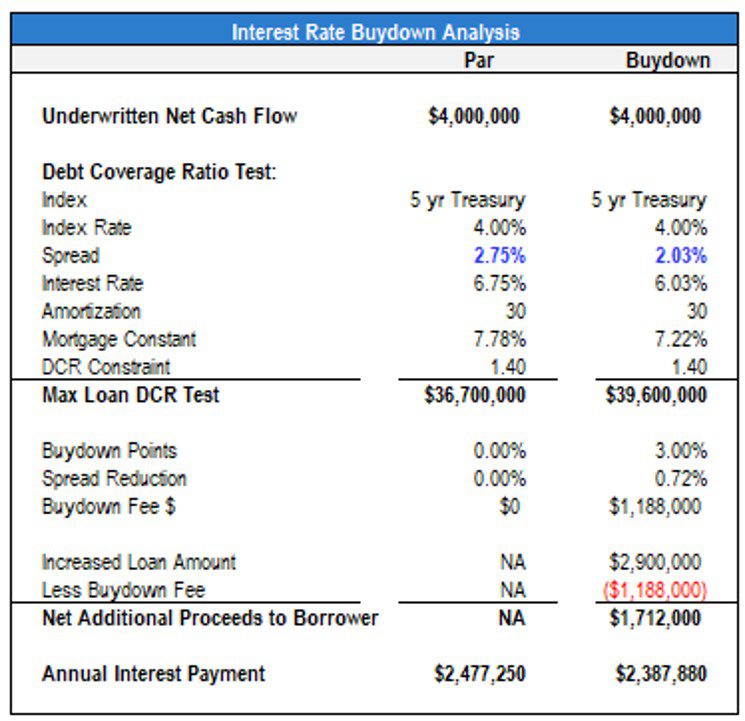

Now lets look at what an interest rate buydown would do in today’s market:

- As of this writing, the 5-year US Treasury Bond is yielding about 4.0% and the spread on a 5-year CMBS loan is right around 2.75%. The all-in interest rate is about 6.75%.

- With a rate buydown, the borrower could further increase his proceeds to get the loan closer to a cash neutral refinance. In this example, a buydown equivalent to a 3% fee would reduce the rate by 0.72% and increase the loan amount to $39.6MM. The loan amount would go up by $2.9MM but be partially offset by the buydown fee to the lender of $1.18MM. The net effect is $1.7MM in additional loan proceeds at closing to be used towards the refinance.

- Interestingly, there is also a net savings in interest paid over the loan term due to the lower rate, even though the proceeds are higher.