Posts by Schelin Uldricks & Co.

$5,000,000

Preferred Equity

Acquistion Sunlit Gardens Rancho Cucamonga, CA 100 Beds Principals of Schelin Uldricks & Co. raised $5MM of preferred equity to acquire an assisted living and memory care property in Rancho Cucamonga, Ca. The sponsor of the acquisition planned to syndicate the property into a DST. The equity enabled the sponsor to acquire the property and…

Read More

$7,314,856

Preferred Equity

Recapitalization615 Pigeon Hill RoadHartford MSA, CT 588,445 SF of Office Space Principals of Schelin Uldricks & Co. raised $7.3MM of preferred equity to effectuate a partnership buyout in a Connecticut office building. The proceeds enabled the remaining partners to continue executing their business plan to stabilize the property.

Read More

$5,250,000

Preferred Equity

Acquisition Pacific View Bandon, OR 99 Beds Principals of Schelin Uldricks & Co. raised $5.25MM of preferred equity for an investment company to acquire an assisted living and memory care property in Bandon, Oregon. The transaction was structured as a Delaware Statuatory Trust and the equity enabled the sponsor to acquire the property and syndicate…

Read More

$5,300,000

Preferred Equity

Recapitalization Pleasanton Office Campus Pleasanton, CA 291,591 SF of Office/R&D Space Principals of Schelin Uldricks & Co. secured $5MM of preferred equity along with $13MM of mezzanine debt and a $47.5MM bridge loan to recapitalize and stabilize a 291,591 SF office campus east of Oakland, CA. The financing enabled a partnership buyout, and provided leasing…

Read More

$13,000,000

Mezzanine Loan

Recapitalization Britannia Pleasanton, CA 291,591 SF of Office/R&D Space Principals of Schelin Uldricks & Co. secured a $13,000,000 mezz loan along with $5MM of preferred equity and a $47.5MM bridge loan to recapitalize and stabilize a 291,591 SF office campus east of Oakland, CA. The financing enabled a partnership buyout, and provided leasing funds to…

Read More

$3,200,000

Preferred Equity

Acquisition Rosewood Specialty Care Hillsboro, OR 48 Beds Principals of Schelin Uldricks & Co. arranged $3.2MM of preferred equity for an investment company to acquire a 48 bed memory care facility in Hillsboro, OR. The transaction was structured as a Delaware Statuatory Trust and the Preferred Equity enabled the investment company to bridge the closing.…

Read More

$10,000,000

Preferred Equity

Recapitalization 176 Addison Road Windsor, CT 605,000 SF of Office Space Principals of Schelin Uldricks & Co. recapitalized a of former Tenant-in-Common transaction with $10MM of preferred equity along with a $32MM bridge loan. The transaction included a discounted payoff of the former mortgage and a lease up of approximately 30% of space within the…

Read More

$28,184,143

Preferred Equity

Recapitalization Met Center 15 Austin, TX 257,600 SF of Office Space Principals of Schelin Uldricks & Co. recapitalized a two-tenant office building leased to Progressive Insurance and Waste Management in Austin, TX. The transaction included a rollup of a tenant-in-common ownership structure, a new guarantor and sponsor, and ongoing structural & foundation remediation. The financing…

Read More

$13,200,000

Preferred Equity

Recapitalization Britannia Business Center I Pleasanton, CA 300,000 SF of Office/R&D Space Principals of Schelin Uldricks & Co. recapitalized and restructured a legacy Tenant-in-Common transaction with a non-recourse bridge loan along with $13.2MM of institutional preferred equity. The transaction included a rollup of the TIC structure, a new sponsor & guarantor, and plans to lease…

Read More

$5,000,000

JV Equity

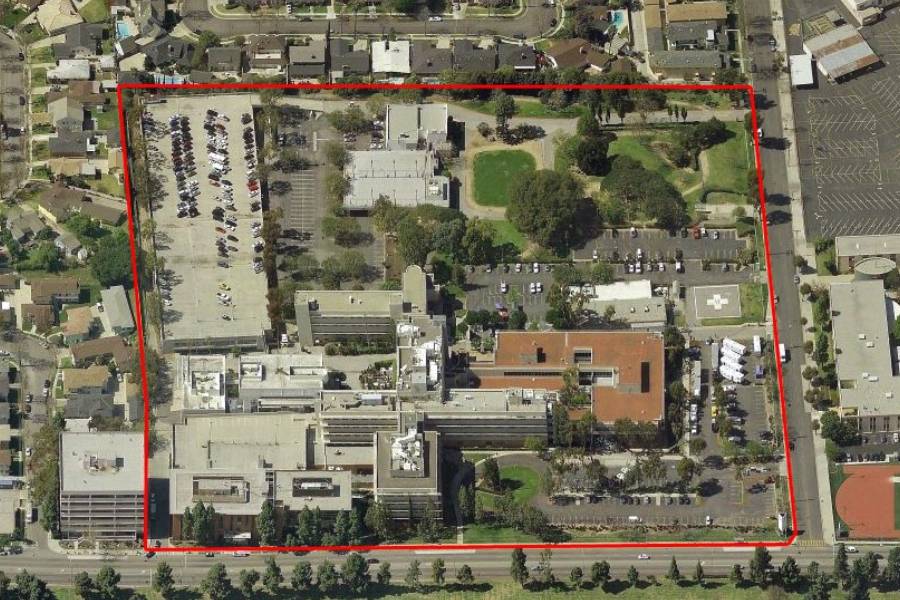

Acquisition Grace Park Inglewood, CA 19 acres of land Principals of Schelin Uldricks & Co. arranged $5MM in joint venture equity along with a bridge loan to acquire and entitle a 19-acre site in Inglewood, CA. At the time of close there was a vacant hospital on the property. The developer’s plans for the site…

Read More